Whether you are brand new to the CPA exam process or currently studying for your upcoming test, this is the CPA exam guide for you! I am confident that you will appreciate the information in this guide and that it will help you in your mission to BEAT the CPA Exam.

If you want the perfect six-month study plan that lays out how you can go from having no CPA knowledge whatsoever to establishing a career in public accounting, look no further!

See the Top CPA Review Courses

- 1. Becker CPA Review Course ◄◄ Endorsed by Big 4 Accounting Firms + Save $1,330

- 2. Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- 3. Gleim CPA Study Materials ◄◄ Largest CPA Test Bank

Step 1: Learn About The CPA Exam

From the words of the AICPA:

“The Uniform CPA Examination protects the public interest by helping to ensure that only qualified individuals become licensed as U.S. Certified Public Accountants (CPAs). Individuals seeking to qualify as CPAs – the only licensed qualification in accounting – are required to pass the CPA Examination.“

What this boils down to is that having CPA certification means that you are qualified above all other candidates to handle a career in finance and accounting. In order to enforce this lofty claim, the AICPA has strict education, age, residency, and experience requirements that must be met prior to sitting for the exam (refer to Step #3 for specific CPA exam requirements).

CPA Exam Format

To test the knowledge of every candidate and ensure that they are fully ready to handle the obligations of an accountant, the CPA exam is split into four different sections, covering the following:

Section #1: Financial Accounting & Reporting (FAR)

Financial Accounting and Reporting is the largest section of the CPA exam. It is centered around general accounting knowledge, such as how to file different costs and account transfers. In addition, this section touches on general concepts relating to finance, resulting in a test that will gauge your specific and theoretical knowledge in the field.

The FAR CPA Exam is made up of the following primary topics:

- Select Transactions (20%-30%)

- Conceptual Framework and Financial Reporting (25-35%)

- Select Financial Statements Accounts (30-40%)

- State and Local Governments (5%-15%)

[uam_ad id=”7978″]

What Is The FAR CPA Exam’s Structure?

When taking the FAR portion of your CPA exam, 2 testlets of 33 multiple choice questions each will be given, resulting in a total of 66 multiple choice questions that you need to answer. Additionally, 3 more Testlets contain a total of 8 Task Based Simulation questions, structured more closely as word problems. These questions are split among the 3 testlets in 2 groups of 3 and 1 group of 2.

How Much Time Do You Have To Complete the FAR section of the CPA Exam?

In total, 4 hours are given for you to complete this portion. You are not required to use the entire length of time to complete the exam, and you will have the opportunity to take a 15 minute break that doesn’t count against this time limit.

How Is the CPA FAR Exam Graded?

When being graded, some of the questions you answer on the FAR exam are pretested. This means they won’t affect your grade and are merely to gauge the effectiveness of the exam. Out of the entire exam, 12 multiple choice questions and one task-based simulation question will not count toward your final grade.

There is an even amount of weight given to both styles of question on the FAR exam, meaning your success in answering the simulation questions has equal bearing on your grade to the multiple choice questions.

Section #2: Regulation (REG)

The Regulation or REG section of the CPA exam is the second largest. It covers many different aspects of taxes and business law in comprehensive detail.

The REG CPA exam tests a student’s knowledge on the following categories:

- (10-20%) Ethics, Professional Responsibilities, and Federal Tax Procedures

- (10-20%) Business law

- (60-80%) Federal Taxation

The REG portion of the CPA exam contains 2 testlets of 38 multiple choice questions each, adding up to 76 multiple choice questions total. In addition, 3 testlets are also included with 8 task based simulation questions, divided among each testlet into 1 group of 2 and 2 groups of 3.

How Much Time Do You Have To Complete the REG CPA Exam?

Much like the FAR portion of the CPA exam, you are given 4 hours to complete this portion as well. Also similar is the optional 15 minute break you are allotted that doesn’t count against this time limit.

How Is the CPA REG Exam Graded and Weighted?

When being graded, 12 of the multiple choices questions and 1 of the task-based simulation questions aren’t counted. This is because they are pretested and are only used to verify how effective the test it. The REG Exam is weighted similarly to the FAR exam, with half of your grade being determined by the multiple choice section and the other half being determined by the simulation section.

Section #3: Auditing & Attestation (AUD)

AUD Auditing and Attestation is not the largest section of the CPA exam, but it is considered by the majority of test takers to be the most difficult. It covers many different aspects of auditing and attestation in a comprehensive manner.

The AUD CPA exam is comprised of the following:

- (15-25%) Ethics, Professional Responsibilities and General Principles

- (20-30%) Assessing Risk and Developing a Planned Response

- (30-40%) Performing Further Procedures and Obtaining Evidence(15-25%) Forming Conclusions and Reporting

What Is The AUD Exam’s structure?

The actual exam divided up in a similar manner to the REG and FAR portions of the CPA exam, with 2 testlets comprised of a total 72 multiple choice questions and 3 testlets containing 8 task based simulations. One thing that is different about this portion when compared to the FAR and REG portions is the addition of document review simulations, but they are still split in the same manner of 2 testlets with 3 questions and 1 testlet of 2 questions.

How Much Time Do You Have To Complete the CPA Audit exam?

You are given 4 hours to complete the AUD exam, with an optional 15 minute break in the middle that doesn’t count towards this time limit.

How is the AUD Exam Graded and Weighted?

When being graded, there are 12 multiple choice questions and 1 task-based simulation question that will not count toward your final grade due to pretesting purposes. Once the remaining questions are calculated, your final exam grade will be weighted equally between both forms of questions; 50% multiple choice and 50% task-based simulations.

Section #4: Business Environment and Concepts (BEC)

Business Environment and Concepts is the shortest of the CPA exam sections, but you should still be prepared for a difficult testing session. It comprehensively covers general business concepts outside of the sphere of general accounting.

The BEC CPA Exam is comprised of the following:

- 17-27% Corporate Governance

- 17-27% Economic Concepts and Analysis

- 11-21% Financial Management

- 15-25% Information Systems and Communications

- 15-25% Operations Management

What Is The BEC Exam’s Structure?

The actual exam is organized into 2 testlets containing 31 multiple choice questions each with a combined total of 62. There are also 3 testlets that contain 4 total task-based simulations and 3 written communications, which are essentially essay questions. These are split into 2 groups of 2 task-based questions and 1 group of 3 written communications.

How Much Time Do You Have To Complete the BEC CPA Exam?

You are given 4 hours to complete the BEC exam, with an optional 15 minute break in between.

How is the BEC Exam Graded and Weighted?

When being graded, 12 multiple choice questions, 1 task-based simulation question, and 1 written communication question is pretested and not counted in your final grade. In a departure from the way the other 3 portions of the CPA exam is weighted, this BEC exam is weighted as follows:

- 50% Multiple Choice

- 35% Simulations

- 15% Written Communications

Additional Testing – CPA Ethics Exam

Depending on what state you live in, you may be required to complete additional ethics-based training in order to receive a CPA license. These states include Minnesota, California, New Jersey, and Texas, while some states such as Pennsylvania, Kentucky, Georgia, and Arkansas do not require ethics certification.

The most popular ethics course used for this purpose is the AICPA’s Professional Ethics: The AICPA’s Comprehensive Course. As an open-book CPE program that emphasizes self-study, it can be completed at any time during the CPA licensing process. You are usually required to pass an ethics exam within two years before applying for certification.

Step 2: Prepare Yourself Mentally For The CPA Exam

If you are serious about passing the CPA exam on your first try, then it is of the utmost importance that you devote all of your time and effort into planning and studying for it. This is an extremely tough test, and you will need it to be your full focus with no distractions in order to succeed.

If you are not 100% mentally prepared to devote long hours every day for the next few months towards studying for the CPA exam, you will inevitably procrastinate, lose focus and fail the test. Now, it isn’t the end of the world if you try and fail and have to retake the exam. However, if you plan it right the first time, you will save yourself the time, grief, and money that comes with the retesting process.

How Long Should I Study for the CPA Exam?

The majority of popular and reputable CPA review courses recommend that you study for a total amount of somewhere between 300-400 credit hours. This is a large time commitment for sure, and it can be incredibly difficult to devote that much time to studying if you’re preoccupied with a job or other classes.

You may be considering spreading those hours out over a longer period of time: something like 3-4 months per section, resulting in a total study time of around 1 year. This way, you wouldn’t have to make drastic lifestyle changes and could study for the CPA exam in your free time.

Unfortunately, this is the wrong attitude to have.

The best way to pass the CPA exam is to take the most advantage of your short term memory. You want to cram for the exam in a shorter period of time so the knowledge is fresh in your head the day of the test.

This may sound counterintuitive at first. After all, it flies in the face of most traditional academic logic that encourages you to cement information in your long-term memory over long years of study.

You have to think about CPA test prep differently from college or high school or any other educational program. The less time you give yourself to study, the more pressure you are going to feel to make progress, and the fresher the material will be on exam day.

If you give yourself 16 weeks to study, you may find it difficult to stay motivated. With your deadline so far away, it can be difficult to stay in ‘all out study mode’ because you feel like your study time is limitless.

If you spend too much time studying, once you finally reach the end of your long journey it is highly likely that you will forget most of the information you learned at the beginning. That’s why it’s so important to strike a balance between enough time to learn all of the material and a short enough period to keep you in crunch mode.

Based on the research I have conducted, this is what I recommend:

Keep a hard deadline of 7-9 weeks. If you do this, you are going to feel immediate pressure to get things done. Additionally, having a shorter period of time like this makes it easier to cut all of the distractions out of your life, since you can then return to your regular obligations sooner. In that 7-9 week period, however, you need to eat, breathe, and sleep the CPA exam.

The CPA exam is supposed to test your ability to perform under pressure and in high-stakes situations, so giving yourself a taste of that pressure will help you perform when it counts. Plus, you won’t have to waste a year of your life studying!

Step 3: Learn About CPA Exam Requirements In Your State

It can be confusing to figure out exactly what is required of you before taking the CPA exam, as it varies from state to state. Do you need an accounting degree? If not, what degree programs are accepted? A great way to eliminate some of the anxiety from the exam is to know without a shadow of a doubt exactly what is required from you in order to take it.

5 Step Process – Signing Up for the CPA Exam:

Signing up for the CPA exam shouldn’t be the scariest part. However, if you find yourself experiencing pre-exam anxiety, following these 5 steps will help you stay oriented towards your goal.

- Review the exam requirements for your state (see link at the end of this step)

- Submit your exam application and find a CPA review course that works best for you

- Request copies of your transcripts and forward them to your state’s accountancy board

- Pay your exam fees and receive a notice to schedule (NTS)

- Schedule your exam at a local Prometric center

What Are The CPA Exam Educational Requirements?

Here’s some general information about the different education requirements to start you off. Keep in mind that this is just a summary; a full list of each state’s requirements can be found at the end of this chapter.

These are the four major educations requirements you will need to meet before taking the CPA exam:

Requirement #1 – Degree

- All states will require you to have a Bachelor’s degree in accounting at the very least. The majority of states will require a Master’s degree in accounting or an equivalent level of higher education.

Requirement #2 – Semester Hours

- In addition to the required degree, states have now started requiring a cumulative total of semester hours spent studying in an accounting program. Depending on the state, you may require 150 semester hours or 120 semester hours in order to sit for the exam.

Requirement #3 – Course Credits

- You are required to verify that you have completed the appropriate amount of course credits and/or credit hours in accounting, business law, and other required classes that will vary depending on your state. In some regions, a modicum of accounting experience in a professional capacity may also be required.

Requirement #4 – Forms

- Regardless of what state you plan on taking the CPA exam in, you will be required to send your college transcripts and CPA exam application to your State Board Of Accountancy. First time applicants will need to allow 4-6 weeks for the completion of the form submission process.

Learn More About The CPA Exam

- How To Become A CPA

- CPA Exam Stats and Facts

- Best Order To Take CPA Exam

- Motivational Songs For Studying

What Are the CPA Exam Residency Requirements?

Out of all the states and provinces you can apply for the CPA exam in, which is the best one for you? Surprisingly, it may not be the one you are living in right now! Most states don’t require proof of residency in order to take the exam there, so you may be able to find a state near you with lighter requirements.

Understanding the different CPA exam residency requirements by state is crucial, especially if you plan to work in a different state than the one you currently live in. It’s possible for you to take the exam in one state and then transfer your CPA credits to another state entirely, once you have established residency and wish to become licensed there.

This is a strategy I’ve heard from many licensed CPA professionals who now work very satisfying careers. With a bit of forethought and research, you can find yourself saving time and money by starting your career earlier than you may have initially expected.

What are the CPA Exam Age Requirements?

Did you know some states don’t have any age requirement at all to take the CPA exam? Great news for all you teenage accounting enthusiasts – in some states, you can become a licensed CPA before you’re even old enough to vote!

Some states do require you to be a certain age, usually around 21 years old, before taking the exam. Don’t worry, though; the majority of states don’t have this age requirement at all. Just ask Belicia Cespedes, the woman in the picture below who received her CPA license at the ripe old age of 17!

Source: AICPA

What Are The CPA Exam Citizenship Requirements?

For all of you aspiring international CPA candidates, I have some good news for you!

Certain states will allow you to take the CPA exam as a non-US citizen. However, some states will still require you to provide proof of citizenship, so non-residential immigrants will need to be mindful of these particular areas when planning their CPA path.

If you would like to know the exact CPA exam requirements for each state, you can find out by clicking this link.

Step 4: Plan For Your Trip To The Prometric Testing Center

If you’ve ever been to the Pentagon, you probably have a good idea of what it’s like to enter a Prometric test center.

You may think I’m kidding, but I’m really not. The security at these testing centers is insane, and they are constantly on the lookout for anyone trying to cheat on their exam.

If you don’t know, Prometric is a national standardized testing center. They work with the National Association of State Boards of Accountancy (NASBA) to proctor CPA exams. Here are some important rules you need to know before entering a Prometric testing center:

- No calculators allowed

- No writing materials (paper, pen, pencils) allowed

- No electronic devices (phones, watches, portable game consoles) allowed

- All visitors will undergo a thorough security scan (TSA-style)

Here are some additional rules you may need to follow in special circumstances, according to the NASBA:

- You must bring two forms of ID (driver’s license, passport, etc.) that match your NTS

- You must arrive at least 30 minutes early to make sure you have enough time to sign in and go through security

- You must place all personal belongings in a locker that will be provided to you

Once you’ve signed in and gotten through all the security checkpoints, you’re finally ready to take the CPA exam. While taking it, you will have a countdown timer present that tracks the amount of time you have remaining to finish the exam.

After each testlet you will also be given the opportunity to take an optional break. You are granted one 15-minute break that will not count against your time. However, any additional breaks that you take, even to go to the bathroom, will be counted against your remaining time!

Step 5: Understand How The CPA Exam Is Graded

It can be difficult to fully grasp how the CPA exam is graded. Fortunately, the AICPA has a helpful resource that can assist you in understanding the entire process.

The CPA exam is extremely complex exam, containing many different variables that can affect your final score. For instance, receiving a grade of 75 does not mean you got 75% of the questions correct. Instead of an exact grade, your score functions more as a percentile, showing you how well you did on the exam compared to everyone else who has taken it. To my best understanding, these are the factors that go into your final exam score:

- As I mentioned in Step 1, some of the exam questions for each section are pretested questions. These are questions that aren’t graded in your final score because they are used to evaluate how effective the exam is overall. It does not matter to your grade if you answer these questions correctly or incorrectly.

- Something else worth noting is that the CPA exam is an adaptive test. This means that it changes based on what questions you correctly answer. Depending on how you answer one multiple choice section, subsequent multiple choice questions can be easier or harder as a result.

- Multiple choice questions are weighted based on their difficulty. This means that answering the right multiple choice questions correctly can matter as much as, if not more than, answering the most multiple choice questions correctly. An individual who answers more low-weighted questions correctly may end up with a lower score than an individual who answered a few high-weighted questions correctly.

The Key Takeaway

The reason why I’m sharing this information with you is to illustrate that there really isn’t a way for you to know how you did on the CPA exam immediately after finishing it. Whether you think you nailed it or you blew it, you simply won’t be able to know until you receive the results.

There are just too many variables to account for. Don’t try to calculate them in your head, because it will just make you will lose motivation and stress you out. Just stay motivated, take your exam sections as they come, and move on to the next one once you’re finished. There’s no use looking back; just keep moving forward!

Step 6: Learn How Register for the CPA Exam

Are you interested in saving hundred of hours of your free time and potentially thousands of dollars of your disposable income while taking the CPA exam? If so, this section will contain information you will want to know.

This step covers:

- How many CPA exam sections to enroll in at a time

- What’s the best order to take the CPA exam sections in?

- How much you should budget for CPA exam fees

The Single Biggest Exam Scheduling Mistake You Can Make

When signing up for the CPA exam for the first time, this is the biggest mistake you can make.

Under no circumstances should you ever sign up for all 4 sections in a row.

You may be unbelievably confident in your abilities. You may have observed all your peers passing the exam on their first try and think to yourself “I had better grades than them, this exam must be a piece of cake!” You may be 100% convinced that you can and will pass all 4 sections the 1st time through.

Have you stopped to consider what happens if you fail even one portion of the CPA exam? This foolhardy confidence can completely undermine months of hard work and hundreds of dollars of your own money!

Let’s unpack this trainwreck of a scenario. Why is this the biggest mistake you can possibly make when signing up for the exam?

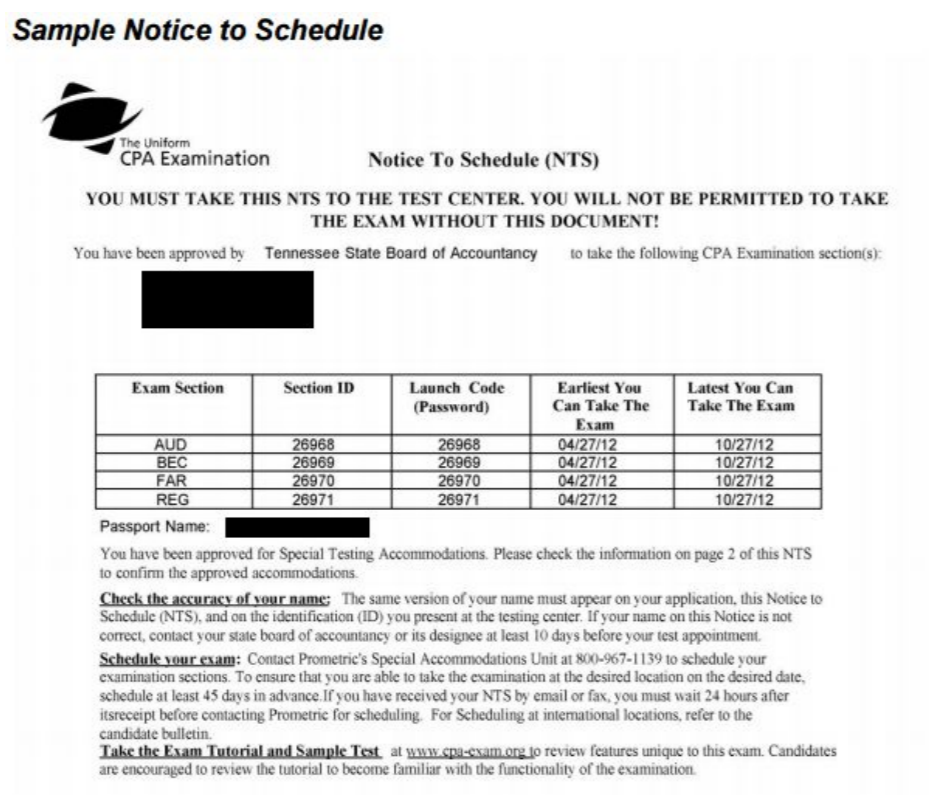

Notice to Schedule (NTS)

Before we identify the mistake, let me explain some important information about the application process. Once your transcripts and application have been approved and you’re cleared to take the exam, your state’s board of accountancy will send you a notice to schedule. Here’s a sample NTS for reference purposes:

Depending on which state you are taking the CPA exam in, you will be given a period of around 6-9 months to take each section. If you schedule all 4 parts at once, you will have a deadline of roughly 6 months to schedule and attend each section of the exam or you will lose your fees.

Are you beginning to see how this could cause problems if you fail one section? Having to retake one section without properly budgeting out time to prepare can prove disastrous. It’s true that some time constraints can inspire you to study harder, but you don’t want that same kind of stress come exam day, believe me.

Getting back to the subject at hand: depending on how many sections you sign up for, they will be listed on your NTS form with the earliest and latest dates you can take the exam on. You will also need to have your section ID and Launch Code password ready for when you’re at the Prometric center, so you don’t want to forget your NTS when you head in for your first exam.

Very important: make sure all of your personal information matches the information on your different forms of ID that you plan to bring to the testing center.

The Right Way to Schedule Your CPA Exam

Now that you have a better understanding of what happens after your CPA exam application gets approved, here is my tip for the best way to schedule your exam:

Sign up for 2 sections at a time.

If you plan your testing period out this way, you can take your first section, start studying for your second section afterward, and then find out the scores for your first exam after a month. This way, you can devote all of your focus and energy on these 2 exams as they occur. Then, once you’ve received the results from your first exam, you have the option to either retake it if you failed or sign up for your third exam.

I am begging you, please don’t make the mistake of signing up for all 4 sections at once! You can easily trigger a domino effect that will cost you dearly. Just sign up for two exams at a time, retake them if you have to, and take it from there. You will make the most of your exam fees and ensure you have enough time and focus to pass at least one or two of the exam sessions.

In What Order Should I Take The CPA Exam?

Your friends and peers may swear that a specific arrangement of exam sections will ensure the highest probability of success, but there’s no real basis for one order being better than any other.

At the end of the day, it’s a grueling and stressful experience to take the CPA exam no matter how you slice it. The question you should be trying to answer instead is…

What Exam Order Works Best For YOU?

During my research into CPA test prep, I have heard three different theories on what order you should take the CPA exam. You can see them below, as well as some reasons why I think they’re flawed.

Tip 1: Start with the easiest/hardest section first.

People will suggest that you either schedule your hardest section first so you can get it out of the way, or that you schedule the easiest section first so you can ease into the rest of the exam. The problem with this strategy is that you won’t know what sections are the easiest or hardest for you when you’re scheduling them, only when you start studying.

Tip 2: Start with the FAR exam and end with BEC exam.

This is a popular choice, since the FAR is commonly considered the hardest and the BEC is considered the easiest. In a hypothetical situation, you should have no problem handling the BEC if you’ve already completed the much more intimidating FAR, but the problem with this strategy is the same as the last; you simply won’t know which section will be easy or hard to you.

Tip 3: Start with the BEC to build up confidence

This is an idea which is based on the premise that the BEC exam is the easiest one. Ensuring you take the easiest exam while you’re fresh and energized can increase your likelihood of passing that section at the very least, but this strategy could come at the expense of your other section’s scores. You definitely don’t want to feel fatigued when it’s time for the FAR exam!

My Advice

Here’s my recommendation for you: start with the topic you are most familiar with.

If your educational background is primarily in taxes and business law, then you may want to take REG first. If you have some experience with or knowledge of auditing, take AUD. If you’re majoring in business, you’ll want to try BEC, and finance majors will want to take FAR.

This strategy is most effective if you are taking the CPA exam right out of college. The section that is most applicable to your college background will seem easier for you than the others if you are able to take that university knowledge and apply it to the exam.

Another effective piece of general advice is to approach all exam sections equally, not drastically changing your study strategies because you assume certain sections will be easier/harder than others.

While it may never hurt to over-study, it will almost definitely hurt if you understudy.

What is the Average Cost To Take The CPA Exam?

| CPA Exam Fees | CPA Exam Cost |

| CPA Review Course | $1,750 |

| Application Fee | $100 |

| Exam Fees (All 4 Sections) | $775 |

| Registration Fee | $250 |

| Ethics Exam Fee | $150 |

| Licencing Fee | $250 |

| Total CPA Exam Cost | $3,275 |

CPA Exam Fees Breakdown

I know, I know: $3,000 dollars is a lot of money. You might be wondering why becoming CPA certified costs this much and what each of the aforementioned fees are actually for. Here’s a handy breakdown of what you’re paying for when you sign up for the CPA exam.

Quick Tip: You can save a bit of money on CPA exam fees if you are a veteran. According to the U.S. Department of Veteran Affairs, you can receive exam fee reimbursements of up to $2,000!

CPA Review Course

This may seem like an optional fee since it isn’t really a requirement to be enrolled in a study course before taking the exam. However, considering how a good CPA course can mean the difference between passing the exam on your first try and failing, wasting your money, and being forced to schedule a retake, this really shouldn’t be considered optional. (More on this in the next step)

My personal recommendation for you is to sign up for a CPA review course once you’ve scheduled your exam date. The reason as to why you should sign up in that specific time frame is because some of the more popular CPA review courses will only grant licenses for a certain period of time. You can ensure that you get the most use out of your review course this way.

Application Fee

Your first real expense when signing up for the exam, besides the review course, is the application fee. This fee can vary depending on what state you are applying to take the exam in, with a typical range of $50-$200. This fee covers the cost of having your application and college transcripts processed. In order to avoid additional fees, make sure that you have all the information you need the first time to prevent the need to reapply later.

Examination Fees

Examination fees are, as you may have expected, the fees for taking each section of the CPA exam. The total cost of these fees can vary from state to state, but an average range is around $175 to $200. This cost can increase if you fail a section of the exam, since you will unfortunately be required to pay the fee for that section again for any retakes.

Registration Fee

For each section of the CPA exam you take an additional registration fee is charged. From what I can tell, there is little to no justification for this fee; it’s just something tacked on to take more money from you. Sorry, that’s just how it is!

The registration fees vary depending on what state you are in when scheduling the exam. In many cases, discounts on these fees are available if you register for multiple exams at the same time. For example, registering for just one exam costs around $60, but registering for two at once can cost around $80. This deal increases the more sections you register for, with deals of around $99 for three sections at once and $180 for all four.

This may make it very tempting for you to sign up for all 4 sections at once and save some money on these fees. However, remember what I told you earlier; it’s a bad idea to sign up for all 4 sections at the same time. You may recall that your NTS only lasts 6 months. What that means is that you would have to complete all 4 exams in that short period of time, giving you no time left over to retake any sections you messed up on.

Trust me, you do not want to sign up for all four sections at once. If you fail even one section, you can end up wasting your registration fees and your other exam fees. You can take slight advantage of the registration fee discount by scheduling two exams at once, but any more than that is a bad idea.

Ethics Exam Fee

For the states that require you to complete their Ethics exam, you will have to pay a fee in order to take their test. This fee can cost anywhere from $125 to $200, depending on the state. My advice for you is to hold off on this one until you have the four CPA exam sections under your belt first; this exam is usually not covered by your NTS, meaning you have more time to complete it.

Licensing Fee

This is going to be your favorite fee of all, because it means you’ve finally made it!

Once you have passed all four CPA exam sections, completed any additional ethics requirements, and clocked in enough hours of work experience, you are officially ready to become a licensed CPA.

This is usually an annual fee that ensures your active status as a licensed CPA. It will vary from state to state, costing anywhere from $50 to $500 a year. You will have to continue paying this fee if you are working as a public accountant and want to maintain your licensed status in that state.

Get Discounts On CPA Review Courses!

Additional CPA Exam Fees

Don’t put away your wallet yet; there’s just a few more fees you’ll need to pay! Some of these fees are optional, while others will only apply to special situations. However, it doesn’t hurt to be informed of these extra charges so you can budget accordingly.

Continuing Education (CPE)

In order to maintain your license, you will need to complete 120 hours of continuing professional education or CPE per year. There are a plethora of CPA CPE course providers that come in a variety of different forms. Depending on your lifestyle and availability, you can take self-study courses, online webinars, and even live physical classes.

Most of these services will offer a year’s worth of CPE credits for a price of around $150 to $600, depending on what specific area you wish to pursue education.

Supplemental CPA Review Materials

Sometimes, one CPA review course just isn’t enough to prepare you for the exam. It’s okay, there’s no shame in needing a little extra help!

If you fail one section of the CPA exam despite taking a study course, you will probably want to invest in some fresh study questions to help you brush up on your sticking points. It’s also a good idea to use some premade flashcards or take an additional cram course to get you a few extra points on your final grade.

CPA Review Course Renewal Fees

If it takes you a bit longer to complete your CPA review course than you initially expected, you may have to pay some additional renewal fees.

Typically a CPA review course will charge in the range of $500 to $1,500 for renewals. However, if you want to cut these costs, you can do what I did and invest in some entirely new study material. Buying practice tests from other sources can cost you around $100 to $600, which can save you a lot of money!

Step 7: Find a CPA Review Course That’s Best For You

Without a doubt, the best course of action that you can take to maximize your chances of passing the CPA exam is picking a review course that will work best with your particular learning style. If the course you choose isn’t designed to play into your learning strengths, it will result in a painful experience of pointless busywork.

In order to help you avoid this fate, I’ve mapped out a 7 step guide to help you pick the right CPA review course for you:

Step 1: How Do You Learn?

Think back to your experiences in college. See if you can pinpoint and write down three of your study strengths and three study weaknesses.

Here’s a helpful resource for determining your learning strengths that was developed by a psychology professor. Take a look at some of the different forms of intelligence listed in that article and find out if any of them apply to you.

Step 2: Are You A Lone Wolf or a Pack Animal?

Based on your favored study style, do you think you learn better on your own or in a group setting? On the multiple intelligence page linked above, try to determine if you are an interpersonal learner or an intrapersonal learner.

Step 3a: Intrapersonal Learners

If you have decided that you are more of an independent studier, you should focus on finding a CPA review course that has a solid textbook, pre-made flashcards, and/or tons of multiple choice practice tests. Video lectures may be helpful as well if you respond well to visual input.

If you fall into this category, I recommend you check out some of these study courses:

Step 3b: Interpersonal Learners

If you have determined that your best learning is done in a classroom environment with other students, then you will want to focus on finding a study course that emphasizes video lectures directly linked to practice tests, live classes, virtual classes, and/or an in-depth study planner to help you maintain structure.

If this description applies to you, you may want to try some of these CPA review courses:

Step 4: Conclude Your Research

Once you’ve pinned down your ideal learning style and researched the options that are available to you, it’s time to narrow down your top three or four choices. You may want to look for reviews from people who have taken these courses and passed their CPA exam.

Step 5: Try The CPA Review Courses You Have Identified

After identifying 2-3 CPA review courses that match how you learn best, sign up for a free trial for each of them. Many of the most popular courses, including many of the ones listed here, will offer some sort of trial experience to help you come to a decision. Here are some trial links that I’ve found:

Wiley CPAexcel Free Trial

Step 6: Find a Discount

Once you’ve decided on the CPA review course of your dreams, look around for a discount code. Many of the popular CPA exam review courses will have discount offers you can use if you’re willing to do some searching!

Step 7: Start Studying

All that’s left for you to do now is to purchase your CPA review course and start studying! As I previously mentioned, the best time to begin is close to your exam signup date. This is so that you can complete any review courses with a time constraint at around the same time you take the exam, so all the information is fresh in your mind. Good luck!

Step 8: Craft the Perfect CPA Exam Study Plan

If you treat the CPA exam like some regular college test, you’re going to have a bad time. This isn’t like a GE class from your first year of university and you aren’t going to get very far if your study plan is just highlighting and memorizing raw data like a robot.

GE tests are mostly specialized and don’t cover a broad amount of concepts. The CPA exam is not like this at all. It is unlike any other test you have done before, even your toughest college final. It is so all-encompassing that it will most likely require study tactics that are completely different from anything you’ve ever had to do in university.

Here are some tips and strategies I’ve found in my research that will help you study effectively and efficiently for this Mother Of All Exams:

Cut the Fat Out

If you’ve successfully determined how you learn best, then you should focus your study plan around those things and cut out anything else. As a personal example, I’m not very receptive to auditory teaching; I prefer visuals-based learning and study best by reading independently. If you’re like me, you may want to skip the video lectures in your study plan.

Obviously you should do what works for you, not just what works for me. If you like video lectures and need a group setting to learn, then maybe you should cut out something else. It’s all about maximizing the effectiveness of your studying while minimizing the amount of time.

This tip can easily save you 15-20 hours of study time per section. That’s 70 hours total saved out of the entire review course!

Don’t Make Your Own Flashcards

When you’re studying for the CPA exam, time is your most valuable resource. Although a common go-to study strategy is to make your own flashcards based off of the material you are studying, You don’t really have the time to do that with this exam.

There are certainly benefits to making your own flash cards, but in this specific situation these benefits did not outweigh the time cost. Because of that, you would probably be better off using premade flashcards to study with instead.

The companies that make the most popular CPA review courses are aware of the most important concepts on the exam; it’s their job to know! If you’re interested in pre-made flashcards, Wiley CPAexcel has some of the best ones I’ve seen. You can try them for yourself by clicking the link below.

Wiley CPAexcel Flashcards

This strategy can save you around 1 hour per week from your study time for each section. Considering the average length of a study session is around 24 weeks, that’s an entire day of study time you can save with this one tip!

Don’t Take Too Much Time on Practice Questions

When tackling the multiple choice sections of the CPA exam, it’s recommended that you don’t spend more than 3-5 minutes on each question in order to make the most of the time given to finish the test. This same logic applies to practice tests as well.

Many CPA review courses with practice questions will also provide analytics to measure how much time you are spending on each question. If you’re struggling to hit this goal for some questions, make it your new goal to reduce that time.

In addition to cutting down on your study time, this tip will also prepare you to take the real CPA exam. This exam is so broad and vast that if you spend too much time on one question, you’re not going to stand a chance of completing the exam on time. In the absolute worst case scenario, skip the question and save it for the end so you can focus on answering the questions you know while you still have time.

This study tip can shave an average of 30 seconds off your time answering each practice question. Assuming that you answer around 1,200 practice questions during your entire CPA review, you can save around 40 hours in total. In addition to saving study time, this strategy has the additional benefit of helping you to identify any trouble areas of the exam and improve your overall exam time.

Breakdown of Total Time Saved

| Skipping lectures: | 70 hours |

| Skipping making flashcards: | 24 hours |

| Reduced average answering time: | 40 hours |

| Total time saved: | 134 hours! |

Please understand that just because these tips worked for a lot of people, it doesn’t guarantee that they will work for you. You are the person who knows the most about your effective study habits, so feel free to take inspiration from these study tips and put your own twist on them.

Step 9: Lock Down Your Final Review Itinerary

Without a doubt, the most important time during your CPA exam study period is the last 2 weeks before your CPA exam test date.

This is commonly known as “Cram Weeks” or “Crunch Time.”

You need to have a solid plan for this 2-week period that ensures you cover everything you need to know before the big day.

Feeling overwhelmed? Don’t sweat it, I’ve got your back!

An MVP Review Itinerary

I want to share with you the best last-minute cram strategy I’ve seen. This plan of attack can help you pass the exam for sure!

I found this strategy from another CPA review resource. They called it the Final Review Study Funnel.

The concept behind the Final Review Study Funnel is to funnel all the information you’ve learned over the last few months of study time into a few weeks. It can help you recall information you learned towards the beginning of your study period, locate and work on your sticking points, and refresh your memory of important mnemonics and other memorization tools.

Phase 1: Comprehensive Review

Crunch time starts when you are 14 days out from exam day. If you’ve been studying effectively up to this point, you should have a solid grasp on all of the material you need to know for the CPA exam. The goal in Phase 1 is not to learn any new information but to begin reviewing all the information you’ve already learned. This phase is made up of four smaller steps:

Step 1: 14 Days Out to 13 Days Out

Take some practice exams that cover everything you’ve gone over during these first two days of your 2-week countdown. I recommend answering about 100-120 multiple choice questions for this stage. Task-based simulations and similar essay questions just aren’t an efficient use of your time at this point in your study plan.

A terrific resource that I recommend for this step is the Gleim CPA Megabank.

Step 2: 12 Days Out to 4 Days Out

Once you’ve finished the practice exams, take a look at the analytics and try to identify any trends in your lower-scoring areas. Set aside an hour or two out of each day to focus on one of these problem areas until you feel more confident about it.

Step 3: 12 Days Out to 4 Days Out (Continued)

Here’s where you get into the real deep dive. Find those topics you’re having trouble with in your study material, be it flashcards, lectures, or the textbook, and use these resources to really drive the point home. The goal here is to ensure that you understand this information, not merely remember it.

Once you’ve ensured that you understand this difficult material, you will be more equipped to answer the questions asked of you than if you simply memorized it. A great way to reinforce this understanding is to create or find another practice test based entirely on these troublesome topics.

Continue this process of identifying weak points, diving into the material, and crafting practice exams until your 4th day out from the CPA exam.

Phase 2: Exam Simulation

By this point in your cram session you should have taken around a dozen or so multiple choice-based practice exams, with a focus on fixing your problem areas and improving your confidence.

Now it’s time for you to put the pressure on and simulate the real experience of taking the CPA exam at the Prometric center. You want to convince your brain that this is the real thing!

Here’s how to do it:

Step 1:

Isolate yourself in one room for the entire length of time that you will be taking the exam: around 4 hours. Turn off and put away your phone, sign off your computer, put away any other electronic devices. Follow the rules outlined by the Prometric testing center as if you were really there.

Quick Tip: If you’re using Gleim’s CPA review products, many of them have an Exam Simulation feature. This can be very useful for you during this stage of your study process.

Step 2:

Using the study materials you have access to, create a 1:1 representation of the CPA exam to the best of your ability. Organize practice tests into sections based on each section of the real exam, divided into testlets of the same length and with the same amount of questions. When you’re ready, start the timer and get to work!

Step 3:

Mentally acclimate yourself to this kind of test environment. The goal at this point is for you to prepare your mind to handle the demands of this exam. This process is almost as important as actually knowing the material on the exam.

Even if you know all the material, you won’t be able to succeed if you can’t handle the test-taking environment. Take this practice exam seriously and treat it like the real thing.

Step 4:

When calculating your score after the exam, try not to be discouraged if you don’t get a passing score. Remember, it’s nearly impossible to predict exactly what kind of results you will receive; some questions are weighted differently, while others are pretested and don’t count toward your score at all.

If you are comfortable in your ability to handle the pressures of the real test environment, then you’ve accomplished everything you need to at this stage of your cram session. This phase should take you right up to the day before the exam.

Phase 3: Relax

This is it. The calm before the storm.

If you’re wondering what is the best way to use this small amount of time left for you, here’s my advice:

You should do nothing.

Focus on relaxing as much as possible. Maybe watch your favorite inspirational movie and make a playlist that you can listen to on the car ride to the testing center the next day.

At this point, the best thing for you to do is to give your brain a chance to recover. You’re going to need it at full strength for the exam, so this is an excellent time to take a break. Have you ever tried mindful meditation? Many have found this simple practice useful when preparing for major life events and it could help you too.

There’s a quote that I love, from an unknown source: “You should sit in meditation for twenty minutes a day, unless you are too busy — then you should sit for an hour.”

Wrap Up

If you’ve followed your CPA review course and implemented this 14 day study plan, you should be ready to take the test once the big day arrives. Get in there and kick the CPA exam’s butt!

Step 10: Prepare For Post-Exam Life

At this point, you’ve finished the CPA exam. Maybe you’re still waiting for your results, or maybe you’ve already received them.

If You Failed The CPA Exam…

If you received your test results and found out you didn’t pass the CPA exam, then I’m sorry. It’s a terrible feeling for sure, but the important thing is to not be discouraged. My advice to you in this situation is to go back to Step 7 and find a new study plan. The best way to ensure that your time wasn’t wasted is to keep going until you make it. I know you can do it if you just keep trying.

NEVER GIVE UP!

If You Passed!

Congratulations! I knew you could do it if you tried. It’s time for you to adjust to what your life is going to be like after receiving CPA certification.

If you plan out your CPA career correctly, you can easily make well over $1,000,000 more during your entire career than you would if you never passed the exam. One million dollars!

The Good News: CPA Certification and Your Career

It can be overwhelming and stressful to consider all of the information you’ll need to know before becoming a licensed CPA. Don’t be discouraged, you can do it! In order to help motivate you to succeed, let’s discuss what passing the CPA exam can do for your future career.

Prestige

Just by passing the CPA exam, you will automatically set yourself from the vast majority of accountants and finance professionals working today. Based on the most recent census data from 2006, there are about 646,000 active CPA in the United States. That’s over half a million, which may not sound so exclusive and prestigious at first. However, when you consider that almost 2 million people work in accounting today, that number seems a lot more impressive.

Employment

By passing the CPA exam, you instantly join an elite group of finance professionals. This boost in prestige will give you a leg up on the competition when it comes to looking for work. According to the Bureau of Labor Statistics, there are a little less than 1.5 million accounting jobs available in the United States. Being CPA certified will help you to be first in line when employers consider applicants to fill one of these job positions.

(Update: Speaking of employment, NASBA has a feature on their website called Experience Verification. This will help you track specific requirements in your location for experience in order to qualify for CPA certification. Check it out!)

Career Versatility

In addition to helping you find a career in finance and accounting, a CPA exam certificate is recognized in many other fields as well. Many positions in the government and academics look favorably on CPA certified applicants, which will make transitioning to one of these careers or industries much easier for you.

Income

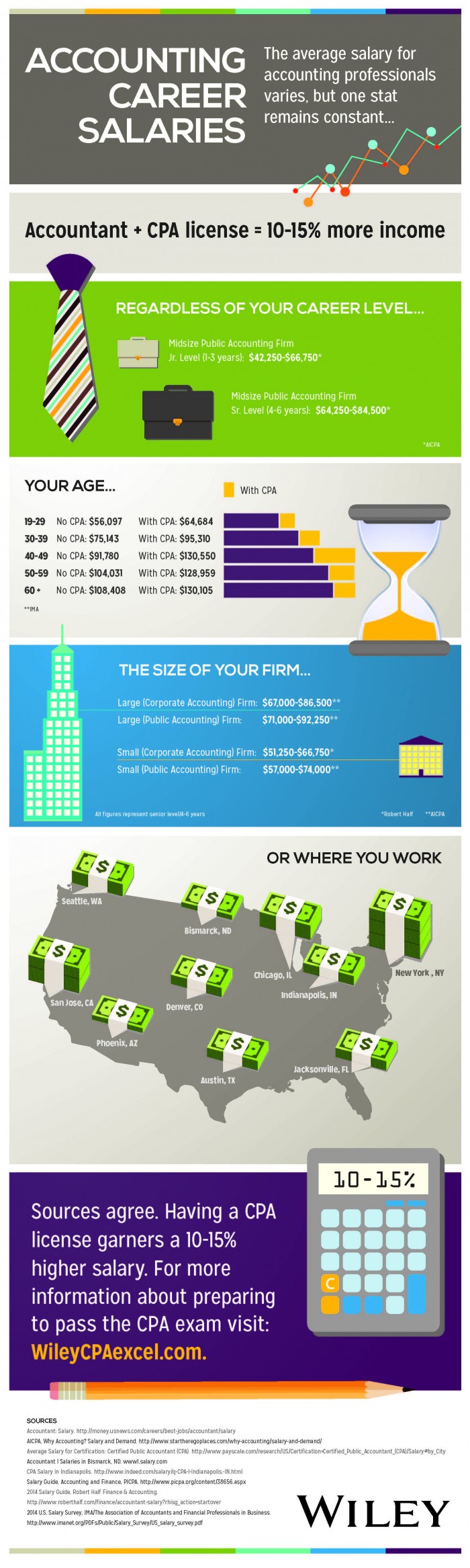

The benefits listed above are nice to have, but the greatest benefit of CPA by far is the monetary advantage you will have over your non-certified peers. There is a very real tangible benefit that becoming a CPA can have on your income, as you can see from the following infographic:

If you want to be the best and most successful accountant you can be, then passing the CPA exam is the best course of action you can take.

With Step 2, we will go over what kind sacrifices you should expect to make in order to become CPA certified. Don’t be scared and remember what they say: if you’re going through hell, keep going!

In Conclusion

Let’s come back to the present, to the time you’re in now, looking at this guide and planning out your future CPA career. Even if you follow all the advice I’ve laid out for you here to the letter, I can’t guarantee you a passing grade.

However, if you do pass the CPA exam, I can guarantee that you will find a way to achieve the results you’re looking for, both in your career and in your life. If you had the strength and ability to get through the exam, you’ll go incredibly far, guaranteed!

Passing this exam and becoming a licensed CPA will open doors for you that you didn’t know even existed. The best part of this is that these doors aren’t all in the realm of finance and accounting. Neither are they necessarily limited to one certain location or city.

I know people who passed the CPA exam and now work as school teachers, consultants, and FBI agents. Nearly every industry recognizes the drive and determination that is expected of licensed CPAs, and this trait will help you to get your foot in the door for many of them.

Pretty cool, right?

Final Piece of Advice

By this point, you’re probably pretty jazzed up about the life you can live as a certified CPA. In the meantime, however, you still need to pass!

How do you do that? I already told you! Just go back to Step 1 and get started. Before you do that, though, I have one more piece of advice to impart on you.

Be prepared to invest in your success.

Unfortunately, achieving success as a CPA will require a significant initial investment on your part. There are no effective or cheap shortcuts to passing the CPA exam that will prevent you from having to give up a great deal of your time and money.

The biggest mistake I see CPA students doing is trying to skimp on a CPA review course. I totally get it: they’re young, probably just recently graduated from college, and are struggling to make ends meet as is. Some of them may already be in debt from getting through university and are balking at the cost to continue their education into certification.

The good news is that if you plan it out well, you won’t have to spend nearly as much on CPA studying than you did to get through college. A good estimate for the average cost is around $1,200-$2,000 for a fully fleshed-out review course that gives you comprehensive tools to help you pass the exam.

You can also check around to see if you can find any discounts. It isn’t hard; you can save a lot of money if you just do a bit of research!

For the most part, I don’t recommend going into debt. However, if you find yourself in a situation where you need to take out a loan in order to take a review course, it’s important to look at it as an investment instead of an expense.

Think of it this way: Is it worth spending $2000 now to earn $25,000 later? This seems like a no-brainer to me. Investing in yourself is the best and most profitable decision anyone can make, accountant or otherwise.

Hopefully this guide helps you achieve success. If you have any questions or comments, please reach out to us in the comments below. I’d love to hear your own stories about how you prepare for the CPA exam. Thanks for reading, and good luck!

Now that you know the roadmap to becoming a CPA, check out our top rated CPA review courses and study materials and get started today!