If you are a tax professional that wants to advance your career, it can be difficult to choose from the alphabet soup of certifications available. Two popular choices are the CPA and EA, but which one is better?

Both are great accounting certifications that will help you get promoted, earn a higher salary, and guide your career in tax preparation, but which one should you get?

Let’s compare each one and see which is right for you!

See the Top CPA Review Courses

- 1. Becker CPA Review Course ◄◄ Endorsed by Big 4 Accounting Firms + Save $1,330

- 2. Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- 3. Gleim CPA Study Materials ◄◄ Largest CPA Test Bank

What is an Enrolled Agent (EA)?

An Enrolled agent is authorized by the U.S. Department of the Treasury to represent taxpayers before the IRS for audits, collections, and appeals, according to the National Association of Enrolled Agents (NAEA).

Enrolled agents advise, represent, and prepare tax returns for all sorts of individuals, partnerships, corporations, estates, trusts and pretty much any entity with tax-reporting requirements.

Enrolled agents also focus on preparing taxes and many specialize in tax resolution.

Enrolled agents are the only taxpayer representatives who receive their unlimited right to practice from the federal government (CPAs and attorneys are licensed by the states). This means if a company or an individual needs to file in more than one state and eventually needs representation before that state in an audit or resolution case, an EA can do both.

People who don’t have the resources to pursue a taxation attorney often hire EAs instead of civil resolution cases. Not only do EAs rates tend to be more affordable, but they can also offer their tax law expertise to clients in tax proceedings, audit hearings, and appeals. EAs help ensure clients are treated appropriately by the IRS, work out payment plans on the best possible terms, and ensure the IRS follows laws that protect taxpayers.

In order to become an EA, you must pass an IRS-administered test commonly referred to as the EA exam. Additionally, you are required to complete at least 72 hours of continuing education every three years. An Enrolled Agent prep course is definitely recommended to study with as the exam contains way too much information to try and go it alone. Here is a helpful comparison chart of the best Enrolled Agent courses on the market.

Learn More About The CPA Exam

- How To Become A CPA

- CPA Exam Stats and Facts

- Best Order To Take CPA Exam

- Motivational Songs For Studying

What is a Certified Public Accountant (CPA)?

A CPA’s bread and butter is performing tax, accounting, and financial services to businesses.

CPAs help individuals and companies with financial planning, investments, taxes, mergers and acquisitions, and much more. CPAs also perform audits as well as examine the annual reports of public companies.

A CPA’s main differentiator is the ability to attest an audit, which means it affirms to the IRS that financial statements are truthful. To do that, a CPA will request bank statements and other proof, which limits the possibility of error.

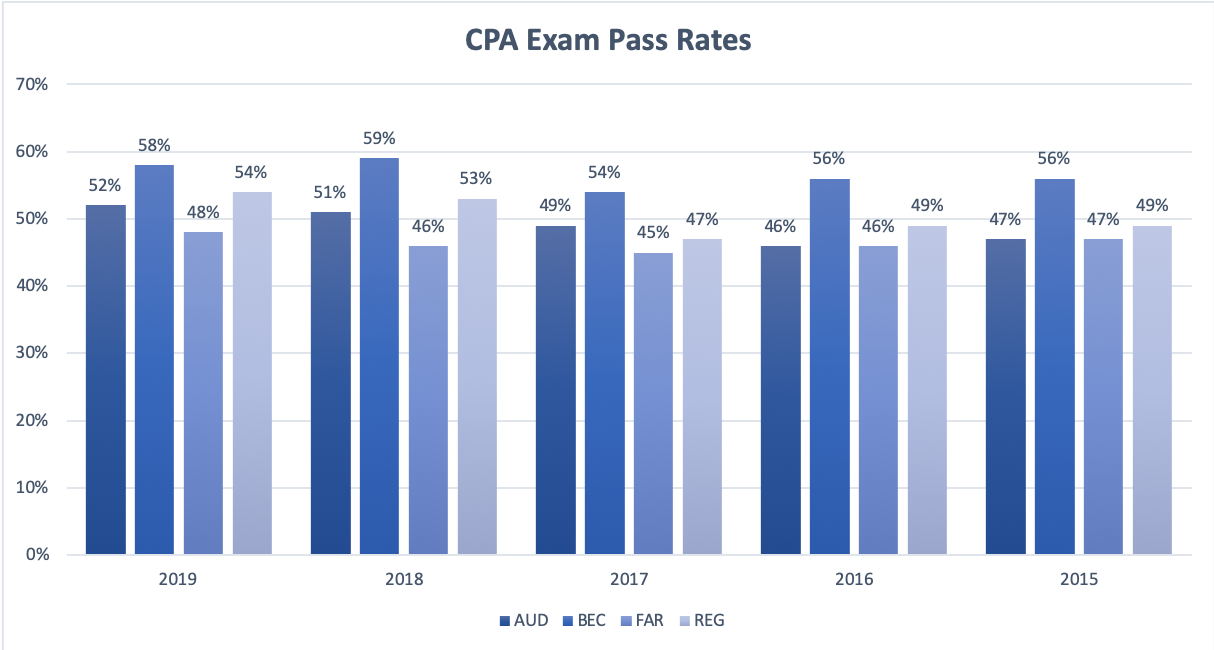

On the average, it takes around 8-9 years to become a CPA. You need to have 150 hours of college credit before you can sit for the CPA exam. Some states also require a certain number of hours worked under the direct supervision of a CPA before taking the exam. The CPA exam has an extremely competitive pass rate and only a 18 month time span to take it.

CPA vs EA: Cost of Licensing

The cost of a CPA license depends on a lot of factors. Where you go to school to complete your 150 credit hour requirement will be one cost. And then you will need a CPA review course, which could add more to the total costs of becoming a CPA.

The cost for sitting for the exam depends entirely on the state in which you plan to be licensed. There typically is a registration fee and separate fees for each section of the exam. (Re-takes require additional fees.) On top of that will be the cost of the license itself, which averages around $150.

And in order to maintain CPA licensure, you will have to take ongoing continuing education (CE) courses, which can also cost a pretty penny. Some employers will pay for all your CPA Exam and continuing education materials, but you may have to foot the bill yourself.

To become an EA, you first must obtain a PTIN (Personal Tax Identification Number) from the IRS, which is now FREE due to a class action lawsuit. The cost of each section of the exam is $111.94. Furthermore, after you’ve passed the exam, you must pay a $30 enrollment fee; that all adds up to $415.82. Enrolled agents also have to take CE courses that fulfill the 72-hour credit requirement every 3 years.

Get Discounts On CPA Review Courses!

EA vs CPA: Salaries

CPAs generally earn more than EAs, but that could vary depending on where you fall on the career ladder. An EA with many years of experience could earn more than a CPA who is only in their first year or two in practice. However, if you are a CPA, your income will certainly outpace that of an EA.

The median salary for a CPA is $62,123 versus $49,000 for an EA.

The income potential for EAs tends to flatten out over time with peak earnings to be around $60,000. CPAs have more opportunities to earn more money. If you are a partner in a CPA firm or a CFO for a conglomerate, you could easily make six figures.

EA or CPA – Which is Better?

I think the better question is, why have both? If you are a CPA, then there is no need to become an EA since the CPA is equally qualified to perform the tax preparation duties of the EA. There are a few cases where it would make sense for a CPA to also become an EA, but it is usually a redundancy for an established CPA to seek EA status.

If you enjoy working with taxes and the challenges of keeping up with complicated regulations, then becoming an EA might be the direction to go. Both the time commitment and costs associated with this career choice are far less than those needed to become a CPA.

However, a CPA can provide a much broader scope of tax services and career choices than an EA. Ultimately, market demand is greater for CPAs than EAs. However, it really all boils down to what your career goals are: public accounting or auditing and attestation.

If you like accounting work with a microfocus, becoming an EA could be a perfect fit for you. On the other hand, if you are interested in accounting practices that have nothing to do with taxes (such as auditing), then the CPA option is the obvious path.